Somalia: Oil thrown on the fire

Energy companies scrambling for reserves risk opening up dangerous faultlines

Energy companies scrambling for reserves risk opening up dangerous faultlines

After an absence of more than 30 years, Abdirizak Omar Mohamed has returned to Somalia, the country of his birth. Last year he gave up his job as a civil servant in the housing sector in Canada to take up a position as one of only 10 ministers in Mogadishu’s new, slimline cabinet.

As minister for natural resources in a dysfunctional country divided by a continuing war, he has to oversee a bulging portfolio that includes water, agriculture, the environment and livestock. As if that were not enough, his brief now also includes hydrocarbons just as Somalia – and east Africa more broadly – has become one of the most attractive frontiers in oil exploration for leading companies such as Royal Dutch Shell and ConocoPhillips.

“The president and I have discussions every day about oil,” says Mr Mohamed in his office that looks out at the Indian Ocean across the tumbledown city of Mogadishu. Late last year, Somalia caught the attention of foreign oil companies by announcing it intended to auction some of 308 newly delineated oil blocks this year.

The world’s leading oil companies are increasingly accepting that their quest for new reserves will take them into challenging new territory. In regions such as the Arctic, the problems are technical.

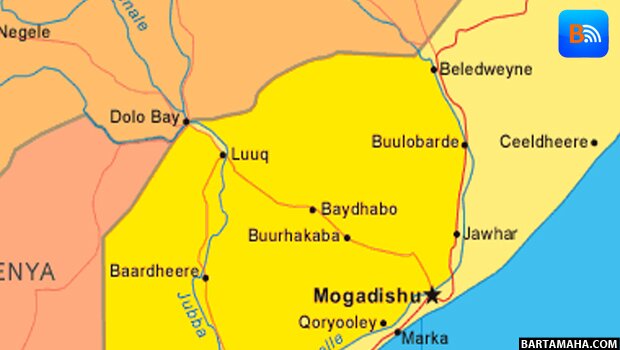

Around the Horn of Africa, companies must calculate whether political and security risks will put too heavy a burden on their production costs. This is hazardous territory in which to operate. A chunk of Somalia is still under the control of al-Shabaab, jihadi militants allied with al-Qaeda. Its wa-ters are the hunting ground of pirates, who since 2005 have earned close to $400m by ransoming 149 vessels.

The politics is also messy, internecine and riven by militias. Oil companies in the race for contracts find themselves unsure whether the power lies in Mogadishu or in semi-autonomous regions such as Puntland or self-declared states such as Galmudug. Somaliland to the north, bordering Djibouti, has declared itself a fully independent republic.

Attempts to carve up oil blocks before the Mogadishu government even controls the whole national territory are undermining efforts to bring peace and stability to a state that has been shattered by 22 years of war and that exports terrorism. The race to lay claim to resources risks triggering wider conflicts: regional authorities have been hostile to central government since the 22-year military dictatorship of Siad Barre. When he was deposed in 1991, warlords carved up the country – and several clan-based militias still hold sway, sometimes cutting deals with al-Shabaab.

The danger is that the race for oil will feed a destabilising rivalry between Mogadishu and other regions – some still influenced by former warlords – just as the international community is celebrating progress. UK ambassador Matt Baugh says the situation remains “very, very fragile”. Rival administrations have issued several companies rights to a clutch of overlapping oil blocks, redrawing the political map of Somalia in line with their own interests.

On an international level, disagreement between Kenya and Somalia over their maritime boundary has also created what one diplomat terms a “triangle of confusion” reaching across 120,000 square kilometres. Kenyan troops defend the port of Kismayo, south of Mogadishu, notionally in support of the Mogadishu government, but Somali officials worry Kenya is keener on securing oil rights.

“The biggest conflicts right now among Somalis are all about oil rights . . . oil is the main player in all of this mess,” says Mohamed Nur of Dissident Nation, a lobby group. “But it’s also a force that allows all sides to have bargaining chips and have an equal role in the future of the nation.”

Indeed, seven months into the job, President Hassan Sheikh Mohamud has called for a consensus, saying he has not yet signed any oil deals. He has also called on international oil companies not to cut their own deals with regional authorities because “that will block their future engagement in Somalia”.

“Resources should not be used as a pretext for new conflict,” he told the Financial Times.

It is a short drive from the president’s office to the well-guarded steps of the resources ministry. From behind the window of his bulletproof vehicle, Mr Mohamed points out the recent additions to Mogadishu’s scars: a car bomb here; a suicide attack there. “We should wait until we have the right laws in place . . . we are not ready yet,” he says, before heading home for a lunch of chips, camel steak, spaghetti and cumin-infused rice. Such a culinary hotch-potch offers a reminder that the former Italian colony has long had to contend with foreign influence and interests.

But oil companies are not proving as patient as Mr Mohamud – or as patient as he would like. A quarter of a century ago, BP, Chevron, Conoco, Eni and Shell bought oil blocks and started ambitious exploration programmes. By 1991 they had all put them on ice, declaring force majeure as civil war took hold. Now several companies want them back.

The Somali government has already started discussions with two previous concession holders – Eni and Shell – that want to reclaim their pre-1991 blocks and enter into production sharing agreements, says a senior government official. He adds that Conoco is also ready to reclaim its stake and that BP is considering the idea.

While the companies have not presented concrete plans, oil executives say they are interested in Somalia should force majeure be lifted.

But hazardous faultlines between competing authorities are beginning to erupt. In February, PetroQuest Africa, an affiliate of US exploration company Liberty Petroleum, signed a deal for a block with the regional government of Galmudug, a self-declared state to the north of Mogadishu.

The move shows how quickly tensions can be inflamed because Liberty’s concession overlaps an offshore block also claimed by Shell. In a letter of April 24, Shell asked the Somali authorities to take action to safeguard its “exclusive rights” to the block.

Mr Mohamed is quick to defend Shell and the pre-eminence of his weak, donor-backed Mogadishu government: “Galmudug should not ever offer any block to any company let alone the Shell block; it should not be signing contracts . . . there’s only one president.”

In Galmudug itself, they see things differently. The president there is Abdi Hasan Awale Qeybdiid, a former warlord portrayed in Black Hawk Down, the film of the disastrous 1993 US mission when Somali militants downed US helicopters and dragged US corpses through the streets. He told the FT that he believed his agreement with Liberty was in line with the new provisional, federal constitution.

“We are not feeling any guilt for this kind of thing,” he says. “If there is a problem between the government and Galmudug we need to discuss, including Shell and Liberty and everyone, let them come to court.”

Phoenix-based Lane Franks, president of PetroQuest and Liberty, co-founded by his brother and US Congressman Trent Franks, suggests Shell should buy them out if the company wants to avoid stoking violence in Somalia. “Shell could still maintain its operatorship by compensating PQ with a modest royalty and reasonable fee to acquire all the PQ rights,” said Mr Franks in a letter to Shell executives on April 9. “Shell would also avoid potential rebellion or backlash from the autonomous states [that could reignite] … at worst, another civil war.”

Abdillahi Mohamud of the East African Energy Forum, another lobby group, warns that such frictions show the stakes are high: “If we see a scramble for petroleum concessions before a political settlement between the federal states and Mogadishu is reached, we can definitely see a new conflict.”

In 2005, when Marcus Edwards-Jones, now non-executive board director of Aim-listed Range Resources, went to Puntland – a semi-autonomous state of northern Somalia – he took a Ukrainian charter plane from Yemen, lured by the promise of data left over from when Conoco conducted surveys there.

“It was a no-go area in those days – humanitarian planes didn’t even land, they would just drop aid out the back of a plane,” says Mr Edwards-Jones. Undaunted, he went on to raise $40m from London fund managers to explore throughout Puntland following an agreement with the government. Range and its partners have put more than $100m into the zone. In addition to drilling two wells, they built an airstrip and deployed 250 troops, led by South African security contractors, to counter al-Shabaab.

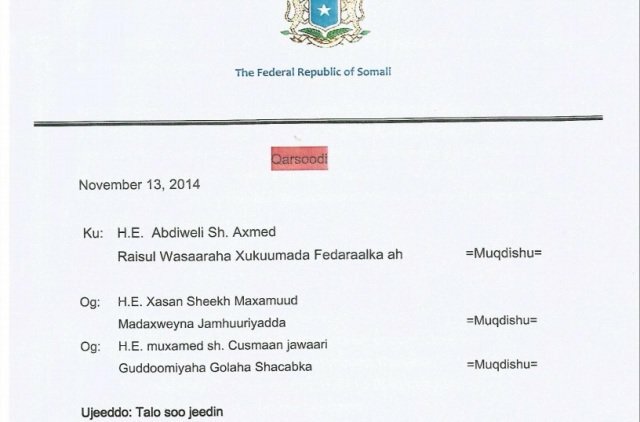

Mr Mohamed insists that any contracts signed with Puntland since 1991 are “null and void”, and ConocoPhillips wrote in 2007 that it had “not relinquished its rights in Somalia”. But Puntland’s government countered in February that the Mogadishu government was interfering “illegitimately on resource exploitation”.

Both Range’s wells were dry, hitting the share price and making it harder to raise money for the next well. But Mr Edwards-Jones says the area is so vast he would need to drill 15 wells before he gave up hope. “We did find traces of hydrocarbons down there; you can miss it by five feet,” he says.

His group has not been able to touch a more attractive block, Nugaal, because it lies in a controversial zone. In fact, Puntland draws its border with Somaliland to accommodate the Nugaal block. “Puntland came up with this creative imaginary boundary to entice oil and gas companies,” says Hussein Abdi Dualeh, Somaliland’s energy minister. He himself faces similar claims from Mogadishu, which says Somaliland has no right to make oil contracts of its own.

Mr Dualeh says the earlier claims in Somaliland have lapsed. He has kept up the pressure by bringing in new companies. Two weeks ago Somaliland signed over a block to Norway’s DNO International. Ophir Energy has an interest in two blocks that overlap former BP blocks. Genel last year took a stake in two other onshore blocks – one of which overlaps a former Conoco block – and is conducting a seismic survey.

“Ninety-five per cent of who has legality is whoever controls the territory,” says Mr Dualeh of Nugaal. “No oil and gas company in their right minds would come in willy-nilly and start doing things.”

But the situation is looking even more complex. The area around Nugaal, Khaatumo, last year declared independence from both Somaliland and Puntland, highlighting the risk that oil could rupture the country.

Mr Mohamed admits there are fissures. He wants to change the constitution – crafted at great expense by Somali lawmakers and UN legal experts – to accommodate an amended version of the 2008 petroleum law, which stipulates that the central government will determine oil deals. “We want oil companies to come into the country . . . but companies are taking huge risks, some of them deliberate.”

Development: A tangle of converging foreign interests

In recent years, foreign involvement in Somalia has been characterised as part of an effort to combat terrorism.

But now Somalis are quick to identify a new set of self-interested motives. “Of course it’s all about oil,” says one senior Somali adviser about Norway’s growing interest in his country.

Norway, whose state oil company Statoil is exploring off east Africa, has made various commitments to Somalia. Oslo has installed solar-powered lamps on the streets of Mogadishu and is setting up a special $30m finance facility.

Last month a Somali parliamentary delegation visited Oslo to discuss

co-operation, development and the management of natural resources. Most critically, these talks included discussion of a triangle of water disputed between Kenya and Somalia.

The Somali parliamentarians rejected a 2009 agreement by the previous transitional government to sign away the triangle to Kenya. That has raised the political stakes surrounding the status of Jubaland, a proposed Somali region neighbouring Kenya that would hold sway over the disputed offshore zone. Diplomats say that Kenya, whose peacekeeping troops guard Kismayo, the port at the economic heart of Jubaland, is keen to assert influence there, against the wishes of the new Mogadishu government.

This tension between Somalia and Kenya matters to western oil interests. Somalia has already warned Statoil, along with Total and Eni, not to accept any oil concessions offered by Kenya in the disputed triangle.

Oslo lobbied hard for a Norwegian to become UN envoy to Somalia. That job instead went this month to a diplomat from the UK, which last week hosted an important conference on Somalia.

The attendees at the conference revealed the range of interests converging on Somalia. Qatar, for example, is an investor in Shell. Turkey has led a diplomatic charge for Somalia by setting up an embassy outside the secure airport compound and delivering prominent support, such as a camp for displaced people, a technical college and scholarships.

In the cold war, the Soviet Union and the US competed for influence in Somalia. But the competing forces are now eminently more complex.

Source: Financial Times

Comments

comments

Calendar

Calendar