Somali community warns bank transfer crackdown could lead to terror funding

ABC News Australia

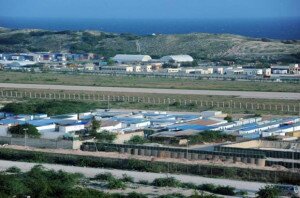

Australia’s Somali community is warning that the threat posed by terror groups in the African country could increase because of tough banking regulations that prevent them from sending money home.

Westpac is the last of the major banks facilitating money transfers between Australia and Somalia, but it will end the service later this month.

The move by Australian banks has been in response to tougher international banking regulations in regards to crime and terror funding.

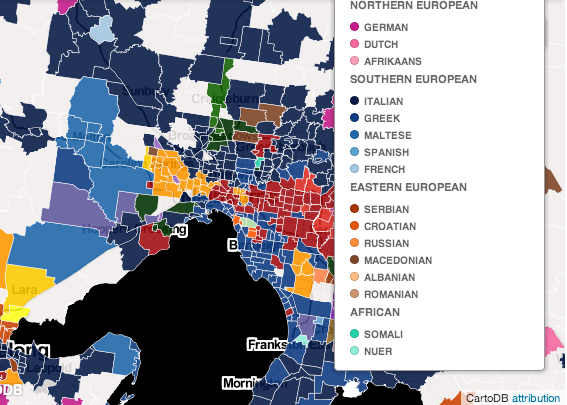

But the crackdown leaves Australia’s 20,000-strong Somali community with no legal way to transfer money home.

Melbourne nurse Nasro Yussf warned this could make people turn to crime to secure the basics for their families.

Ms Yussf sends $400 to her family each month to pay for food, shelter and the education of two of her cousins.

She said if she could not continue to send money home, her cousins would be pulled out of school.

“Basic necessities like food and shelter and education and health are reliant on the diaspora community and if that stops then people are going to turn to crime,” Ms Yussf said.

“People will seek help or accept help from (terror group) Al Shabab, (who) say ‘we’ll support your every move if you can feed us’.

“Stopping the remittance flow of money will stop the country’s progress in its tracks.”

The UN has estimated in some parts of Somalia up to 40 per cent of families are reliant on money sent from overseas.

There is no structural economy in the country and the unemployment rate is more than 50 per cent.

Crackdown ‘could force money onto black market’

Most Australian Somalis use businesses that use the “hawala” system to send money to Somalia as there are no formal banks in the war-torn country.

Money is paid out in Somalia without actually being transferred and the debt is settled at a later date, often by through a bank account in a third country.

However, the operations require bank accounts outside Somalia to operate.

Financial crime expert Dr Hugh McDermott said the banks had been forced to stop servicing the businesses because they could not prove where the money was going once it left their networks.

“There’s been an ongoing concern for a couple of years, led by the AFP (Australian Federal Police), that if (remitters) weren’t regulated and weren’t controlled, terror groups could pass money offshore and you wouldn’t be able to tell where that went,” Mr McDermott said.

But he said the crackdown could force more money into criminal networks and terror groups.

“Legitimate regulated remitters will go out of business because they can’t transfer the money, and so people in different ethnic communities will go to underground remitters which is often organised crime or have links to terrorism.”

Banks in the UK and USA have also been tightening regulations around remittances to Somalia.

However government interventions in both countries mean money is still flowing for now.

Chairman of the Somali Australian Council of Victoria Hussein Haraco said similar action needed to happen Australia.

“This is a real life line for people in Somalia,” Mr Haraco said.

“We want the Government and the banks to talk and come up with a solution.”

A spokesperson for the Attorney-General’s department said the situation was challenging and it was monitoring the situation.

Comments

comments

Calendar

Calendar