Westpac keeps Somali money transfers open until Federal Court hearing

Heidelberg Leader

The financial institution is the last of the big four Australian banks to offer money transfer services to the remittance operators helping Somalis send cash to their families overseas.

The Leader previously reported the bank had advised Somali remittance operators at the Bell Street Mall they would close their accounts on Monday, November 24.

But Westpac spokesman Danny John said the bank consented to temporary orders made in the Federal Court in Sydney on Friday, November 21.

“These will be in place until a further hearing of the matter in court … (on Friday, November 28),” Mr Johns said.

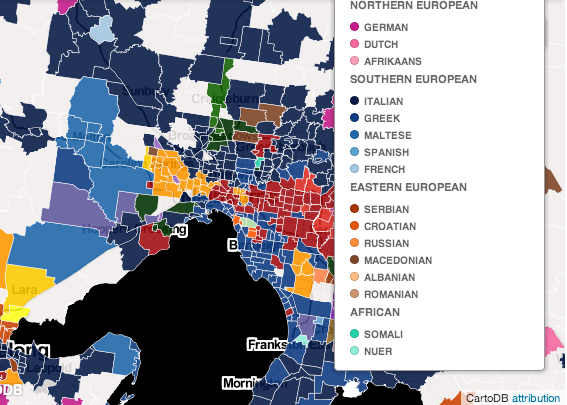

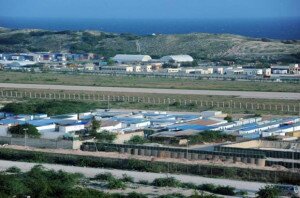

About 10,000 Somalis across Australia — many living in Heidelberg West — will no longer be able to transfer money back to their families overseas once the bank shuts down accounts with remittance services.

Kensington elder Abdurahman Jama Osman, who sends $100 every month to 85-year-old sister Halima, said he was deeply worried about her future.

The tightening of global and Australian financial regulations around anti-money laundering and counter-terrorism has meant many banks are shutting off services to remittance operators because of security concerns.

Somali Remittance Action Group Chair Hussein Haraco — who is not part of the Federal Court action — was in a delegation that travelled to Canberra this week and submitted a 2500-signature petition seeking a solution.

Dr Haraco said the group met with the Attorney General’s department, the Department of Foreign Affairs and Trade and Austrac — Australia’s anti-money laundering and counter-terrorism financing regulator and financial intelligence unit — about the remittance closures.

“Westpac is the last major Australian bank holding accounts of small money transfer operators who transfer remittances from communities in Australia back to family in developing nations such as Somalia,” Dr Haraco said.

“Somali money transfer operators have worked to fill the huge gap left by the lack of financial institutions in Somalia.

“In a country where over three million people do not have enough to eat, cutting off this vital lifeline without a viable alternative in place could be catastrophic.”

Dr Haraco said he believed the Federal Government agencies were committed to organising a meeting with the four major banks, Australian Bankers’ Association and money remitters.

An Attorney General’s department spokesman, who did not want to be named, said the Federal Government recognised remittances represented a major source of income for millions of people across the world.

“Somalia is particularly problematic as there are no banks … so they are entirely reliant on alternative remittance services provided from outside the formal banking system,” the spokesman said.

“The Government will continue to monitor the remittance sector to assess the scope and wider implications of bank account closures and will continue to consult with affected stakeholders as necessary.”

Australian Bankers’ Association chief executive Steve Münchenberg. Picture: Tim Carrafa

Australian Bankers’ Association chief executive Steven Münchenberg said banks had preliminary discussions with the Government.

“While it is clear there are no easy solutions, the banking industry remains committed to playing our part in trying to address the problems that have arisen from the growing international and domestic regulatory requirements, in particular around anti-money laundering and counter terrorism laws,” Mr Münchenberg said.

Comments

comments

Calendar

Calendar